Ad Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. There are many reasons that keep a person from planning for retirement years.

Issues and Challenges 1.

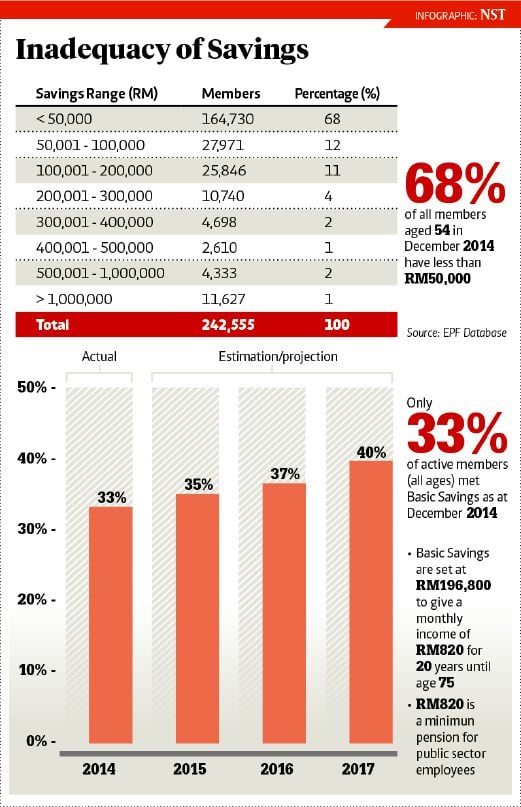

. Statistics show that two out of three Employees Provident Fund EPF members aged 54 have less than RM50000 in retirement savings. Find income strategies for your 500K retirement savings in this free guide. As a part of Islamic wealth management Islamic retirement.

More than four in five 83 of Malaysians polled in a survey commissioned by Manulife say they own insurance with 70 planning to buy more. Globe on retirement studies in Malaysia on retirement planning is deemed just as important. Knowing where you are with your retirement plan gives you essential context to make big decisions with confidence.

Malaysian Getting Older at Unprecedented Speed The needs for retirement financial planning has become more important when Malaysian is getting older at unprecedented speed. Multiply with the cost of longevity. The importance of retirement planning is a call in Malaysia due to fast ageing population in the country.

Making better financial and life decisions is another major reason why retirement planning is important. Financial education and better financial planning have become more important than ever to help Malaysians in managing their financial future said Securities Commission Malaysia SC chairman Datuk Seri Dr Awang Adek HussinHe said retirement security is one of several significant long-term domestic issues that the nation must. Malaysia Life Health.

Enjoy a happier marriage. 22 Retirement planning behavior Personal retirement planning is not compulsory but a personal option for future preparation. Retirement funds or pension funds are investment avenues that allow individuals to save a portion of their income for retirement.

Also having a retirement fund is planning for retirement is an indicator of high financial IQ. Thats why its important to plan for retirement whether youve just started working or have been in the workforce for decades. For example if your monthly expenditure is RM3000 today that same amount would be higher at your retirement.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. In Malaysia even though they are aware of the importance of financial planning most of them lack knowledge on the benefits of it Gan 2008. This paper aims to discuss the important of Islamic Retirement Planning in Malaysia.

Talk to a Financial Advisor. KUALA LUMPUR July 27. Population ageing defined as relative increase in the number of the.

Its no surprise that money issues are a leading cause of divorce. Ad Start Preparing Today to Save for Your Retirement. Life insurance sector studies players stance on data-driven operations.

Currently the retirement plans available in Malaysia such as employee provident fund EPF and pension. Ad Our approach to building customized portfolios with a simple flexible solution. Central bank releases exposure draft on professionalism of insurance and takaful agents.

Learn about PIMCOs framework for retirement investing for income and long-term growth. Retirement Planning in Malaysia. Ad Get your free copy of The Definitive Guide to Retirement Income today.

Discover Which Retirement Options Align with Your Financial Needs. Women Family and Community Development Minister Datuk Seri Rohani Abdul Karim said a forecast by the Statistics Department showed that. This puts them at risk of living below the poverty line.

Explore Tools That Allow You To Access Insights On Retirement Concerns. Suggestion for Improvement In the nut shell the retirement planning is crucial in order to sustain current lifestyle after retirement. Consider that the cost of living may be significantly higher when you retire in the future considering the rate of inflation.

This is because retirees age 60 years and above population in Malaysia is progressively increasing. These are as important as the emergency fund or we can also say it is one of the essential prerequisites of old age. The current inflation rate is expected to be around 31 in 2020.

Build Your Future With a Firm that has 85 Years of Retirement Experience.

Climate Weather In Malaysia Retire In Malaysia Part 1 Retirepedia Malaysia Resorts Malaysia Retire Abroad

Who Wants To Live Forever Life Expectancy Chart Living Forever

Should I Retire To Malaysia Money Saving Mom How To Start A Blog Money Saving Tips

Living The Good Life Abroad The 22 Best Places To Retire

Educating Malaysians On Retirement Savings

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle

Pdf Retirement Awareness Among The Working Population Below 40 In Malaysia

Retirement In Malaysia Part 9 Culture People Retirepedia Malaysia Culture People

Life Insurance Agent Kuala Lumpur Takaful Insurance Agent Kuala Lumpur Medical Card

The 10 Things You Want To Know Before Your Malaysia Holidays Malaysia Destination Malaysia Malaysia Travel

Weather For Kuala Lumpur Malaysia Federal Territory Of Kuala Lumpur Malaysia Web Development Design Precipitation Kuala Lumpur

Pdf Factors Affecting Retirement Planning Of Gen Y Workers In Klang Valley Private Sectors Malaysia

Pdf The Importance Of Islamic Retirement Planning In Malaysia

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

Pdf Financial Literacy Key To Retirement Planning In Malaysia

Retire In Malaysia What You Need To Know Retirepedia Malaysia Retirement Impossible Dream

Is It Time To Reithink Your Investments Investing Real Estate Investment Trust Infographic

By Maintaining A Positive Attitude And Zest For Life Exploring Your Dreams Updating Your Looks Increasing Y Positive Attitude Finding Yourself Stay In Shape

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar